Are mutual fund fees inherently bad? No.

Is paying too much in fees bad? Yes.

Do fees erode performance? Yes.

Is there such a thing as a free lunch? No

Finally, cost is what you pay, value is what you get. Alright, we got it.

Over the course of my career, I’ve seen a lot of changes since I started in 2001. There are a lot of new ways to invest, and fees and expenses have come down quite a bit. Those are both really good things, but it doesn’t mean you don’t need to pay attention to what you’re paying.

I remember the first time I learned about basis points, and was disgusted by how much people were being charged for financial products and services. Not only that, but it was also really hard for consumers to figure out the total costs they were paying. Ever since then, I’ve been really fee sensitive.

Even though I work in the industry, I’m an advocate for investors. Last things about me; I’m honored to have been to Investopedia’s list of the top 100 financial advisors many years running.

My goal here is to educate you on how fees work, where you can figure out how much you’re paying, and what your options are moving forward.

Here’s what we’ll cover:

- The cost of fees

- The different kinds of fees

- Available alternatives

- The way forward

Let’s get started.

The cost of fees

Any conversation about fees needs to begin with an explanation of basis points. Basis points are the way financial companies charge fees and make money, and they are represented by percentages.

An easy way to understand what basis points are is to compare them to $1. $1 is equal to 100 pennies. 1% is equal to 100 basis points.

100 basis points equals 1%

50 basis points equals .50%

1 basis point equals .01%

150 basis points equals 1.50%

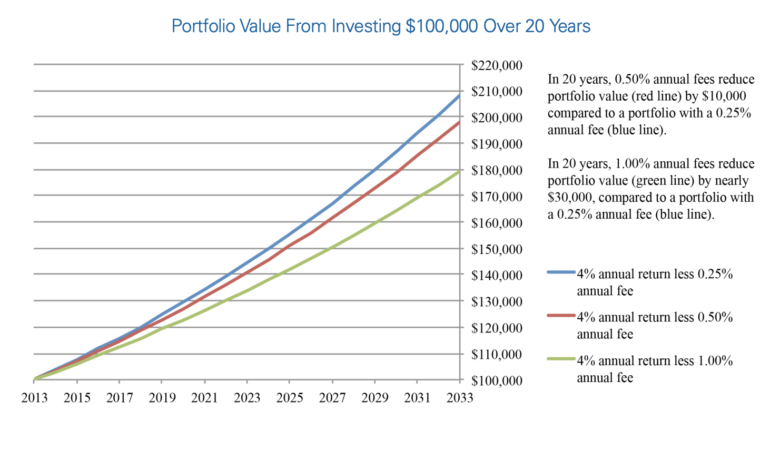

Small amounts today add up to big amounts over time. There’s a great piece by the SEC that breaks down the impact of small amounts over long periods of time. Bottom line- you’ve gotta pay attention to how much you’re paying in fees and expenses.

The different kinds of fees

There are a lot of different ways financial companies and professionals make money. I’m going to go over the most common and how you can figure out what you’re paying.

Mutual fund and ETF fees

Mutual funds and Exchange Traded Funds are two of the popular investments, and the common found inside of retirement plans like 401(k)s and IRAs. These investments charge fees known as expense ratios. The fees go to pay for operating expenses as well as profits. A great place to research the expense ratio of a mutual fund is Morningstar.com.

Above, you can see the price of a very popular investment, the Vanguard S&P 500 ETF. You can see the “Net Expense Ratio” is .03%, which we know is 3 basis points. For all intents and purposes, this is very inexpensive.

Below is an example of a very expensive mutual fund:

This mutual fund has a fee called a “Front Load” of 5.75%, or 575 basis points. On top of that front load, there is also a net expense ratio of 4.42%.

Managed accounts

A managed account is when you are the owner of an investment account, but you’re paying someone else to oversee it for you. This can happen when you work with a financial advisor, and it’s also how Robo-Advisors work.

There are commonly two types of fees associated with managed accounts. First, you’ll pay the expense ratio for each of the underlying investments inside of your account (what we just went over). Second, you’ll pay an Advisory fee, which is the cost you’re paying for the financial advisor or entity to make investment decisions on your behalf.

Below, you’ll see an example of a managed account. In this example, the advisory fee is .35%, or 35 basis points. To find the total fees you’re paying, you’ll need to determine the expense ratios of the investments and add that number to the .35%.

Financial professionals

Financial professionals

There are a lot of different types of financial professionals. There are a lot of different ways financial professionals make money. What’s important to know is this; none of them work for free. To know how the professional you’re working with, or thinking about working with is compensated, simply ask. Here’s a post on the best questions to ask.

401(k)s

No, your 401(k) isn’t free. In fact, there are more fees and expenses in these accounts than in most others. It costs money to manage a 401(k), so there are fees to charge to cover pay them.

The investments inside the plan each have an expense ratio.

There may also be an advisory, or program fee associated with the account as well. Here’s the good news; you can request a 408(b)(2) total fee disclosure from your company’s leadership, or request it directly from the financial company.

We’re happy to review yours if you have questions. Feel free to reach out.

Available alternatives

Is it possible to move beyond fees with your investing?

You could forego mutual fund and ETF fees and simply purchase individual stocks, bonds, crypto, and or real estate. The challenge with that approach is diversification.

I never recommend anyone have more than 5% of their total net worth in any one investment. If you decide to go down the road of buying individual securities (stocks), please keep that in mind.

If you’re fee-sensitive (or fee-adverse), keep in mind the cost of that S&P 500 ETF from earlier; it was .03%, or 3 basis points. That’s almost free. If you owned $100,000 worth of it, you’d be paying an annual fee of $30.

To clarify what the S&P 500 is, it’s the biggest 500 American companies on the stock market. So when you guy 1 share of it, you own a piece of all 500.

Buying one share of just the top 10 companies would cost more than $8,000.

With that in mind, I think there’s a ton of value in mutual fund and EFT investing. Just pay attention to the fees you’re paying and keep everything in perspective.

The way forward

I’ve worked in personal finance for over 20 years, and the vast majority of my investments are in mutual funds and ETFs. That doesn’t mean it’s the right approach for you, it’s just some additional food for thought.

A big key to being successful with money and investing is taking an active interest in it. There will never be anyone more interested in your financial success than you are.

Act accordingly.

If you’re ready to take control of your financial life, check out our DIY Financial Plan course.

We’ve got three free courses as well: Our Goals Course, Values Course, and our Get Out of Debt course.

Connect with one of our Certified Partners to get any question answered.

If you’d like help getting on the same page with your partner, check out our Same $ Page Course.

If you’d like to help your kids get good with money, check out our Teaching Kids about Money course.

Stay up to date by getting our monthly updates.

Check out the LifeBlood podcast.

LifeBlood is supported by our audience. If you purchase through links on our site, we may earn an affiliate commission. Learn more.